Inhaltsverzeichnis

Cash guidelines (AT) and procedural documentation

Document signing

Since 01.04.2017, document signing has also been required in Austria. In order to be able to offer you a simple and secure solution here, PC CADDIE continues to work with Efsta together.

You have the option of having the receipt signed via a SmartCard connected locally to the cash register or server or via the SignServer.

The disadvantage of the SmartCard is that you need a type of USB stick which is plugged into the server or the respective checkout stations. No additional hardware is required for the SignServer.

The following Pakete are available from Efsta. We recommend the „EFSTA SECURE - Server“ package. With this package, a connection to the signature server for document signing is possible and an additional very important point is that data storage is guaranteed for 10 years (audit-proof). This package offers the following 2 optional points: „- document archiving in accordance with § 132 para. 2 BAO“ and the option for „- digital cash receipts“.

In addition to this service from Efsta, you will of course also need the actual signature unit, which ultimately generates the receipt signatures for your cash registers. You can choose between the following Produkten options. At this point, the question is whether you want to work with hardware or with the SignServer. If you decide in favour of one of the remote signing products, consider the speed of transmission and whether you prefer support in emergencies between 8am and 6pm or 24/7. Basically, the following two alternatives will fulfil your normal needs:

PrimeSign Cash Register Bundle K30

Signature unit with smartcard for plugging into the cash register or server.

For smaller installations, this is fine as an inexpensive solution. Hardware (this USB stick) must be installed locally and the smartcard must always be inserted and working. In theory, however, you are independent of the Internet.

PrimeSign Remote Signing SaaS for RKSV 150 / 8-18

Remote signing via the PrimeSign server with response times of 150ms and support from 8am to 6pm. This should be the right package for normal golf course operations.

We recommend this package for larger installations. Only this package can be used for cloud solutions. You don't have to worry about the hardware, everything runs online. You may not need to worry if there is a temporary internet outage - in this case, the system will continue to issue provisional signatures with the addition „Signature unit failed“. This is perfectly permissible in exceptional cases and ensures the uninterrupted functioning of your cash register. So you don't have to worry - but in principle, the Internet should of course work reliably and constantly for this solution.

Please note: All prices are informative and subject to VAT. - We will inform you here about the options and support you with the installation by ordering the certificates for you as required. The contractual partners and invoicing parties for these services are Efsta and PrimeSign.

To register the cash register with FinanzOnline via Efsta, you need the participant ID / user ID and PIN from your webservice online access. Please note that these must not be longer than 12 characters.

Legal basis

As part of the 2016 tax reform, the cash register package was adopted, which on the one hand the cash register obligation on the one hand and the obligation to create receipts and the obligation to accept receipts. Since 1 April 2017, electronic recording systems must also be tamper-proof. With our PC CADDIE interface zuefsta you can deal with this in a relaxed manner, as it offers you legal certainty vis-à-vis the EU tax authorities.

Technical documentation

Cash register type

The PC CADDIE POS system is a database-based POS system and therefore corresponds to POS type 3 according to POS guidelines.

Description of the security device (E 131)

1. design and data structure

Essential databases:

GOLFKONT.DBF All bookings - basically all figures can be found here.

GOLFMITG.DBF Member and customer data - possibly important for the restriction to customer groups.

GOLFBEIT.DBF Contributions and articles - possibly relevant for the analysis by article

The following databases could be supplemented if required, but the documents are all already contained in GOLFKONT.DBF:

PCC_KASS.DBF Cash register database of currently open cash transactions from daily closing to daily closing.

PCC_KAAR.DBF Archive database into which the cash transactions from PCC_KASS.DBF are copied at the end of the day.

PCC_EFSA.DBF Cash register data entry log - chronological archive of postings

2. booking process

During a checkout process, an article is immediately entered in the PCC_KASS.DBF with a data record.

The cash transactions are recorded chronologically and managed twice: On the one hand in the cash transactions database and on completion of the document posting in the overall journal. All transactions are assigned an ascending document number when they are posted. Item details, date, time, the operator ID and, if available, the till number are recorded for these transactions.

At the moment the receipt is printed, this step can no longer be cancelled undocumented. Each individual item can then only be cancelled out by an offsetting entry with a negative number. The date, time and operator ID are also recorded.

When the cash transaction is finalised by a payment transaction (or posting to a clearing account (OP area)), all voucher postings are transferred to GOLFKONT.DBF and noted in the data entry log.

This means that there can be no item or invoice cancellation in the structure that is not ultimately traceable in the GOLFKONT.DBF.

Data records are not deleted or reorganised at database level. In the databases, new business transactions are always appended at the end so that the chronology always remains traceable.

The software never deletes a data record in the GOLFKONT.DBF of the cash register. However, if vouchers are cancelled, the line items of the cancelled voucher are marked with a „D“ (=deleted) in the KONTTYP field. The line items are cleared again individually during the cancellation process, if necessary by an offsetting entry.

A detailed description of the cash register operation can be found here:

3. documentation / journals / receipts

3.1 Daily closing

The daily closing contains the following contents:

- Name of the company

- Date and time of preparation

- Consecutive daily closing number

- Total turnover

- Turnover by tax rate

- Breakdown of revenue by payment type

- Sales by operator

- Cancellations and discounts carried out

3.2 External document

Obligation to provide receipts from 1 January 2016

As of 1 January 2016, entrepreneurs are generally obliged to create a receipt for cash payments and hand it over to the buyer.

The external receipt contains the following information:

- Name of the company

- Characteristic for cash register identification

- Date and time of document creation

- Receipt number

- Individual products and price

- Total amount

- From 1 January 2017, signature that is created by a signature creation device connected to the cash register by integrating the contents of the receipt (EFSTA)

The amount paid in cash must be itemised according to tax rates.

We will be happy to support you with the installation.

3.3 Outgoing voucher list with the consecutive numbers and amounts of the sales vouchers (outgoing invoice list)

Creating the outgoing voucher list

3.4 Sales statistics for analysing postings according to articles and product groups, each of which can be combined with the document numbers

3.5 Evaluations of price changes and cancellations

Creating the list of price changes

4. data backup / data export

All transactions are stored in databases on data carriers in the cash register or on the customer's server. The customer is always responsible for backing up this data. We recommend backing up data by storing it unalterably on an external data carrier. The backed-up data must provide the same analyses as the running POS system.

5. interface

We offer an interface to the efsta (European Fiscal Standards Association). The efsta is an international independent organisation for the promotion of legal certainty, IT security and fraud prevention in the European fiscal sector through the establishment, dissemination and further development of the efsta standard for the documentation of business processes subject to record-keeping within the framework of national and international guidelines.

It also has a data collection protocol. The data collection protocol contains the following content:

- All sales transactions in chronological order

- Booking information with VAT, article details, cash register number, operator ID

- Data records are provided with a hash value that can be used to check for manipulation. The key for this hash value is unknown to the cash register user. It can be transmitted to the auditing body in the event of an audit.

Here the customer is protected against falsification by the creation of a hash value, as well as against data loss.

EFSTA receipts

Retrieve and print monthly receipts

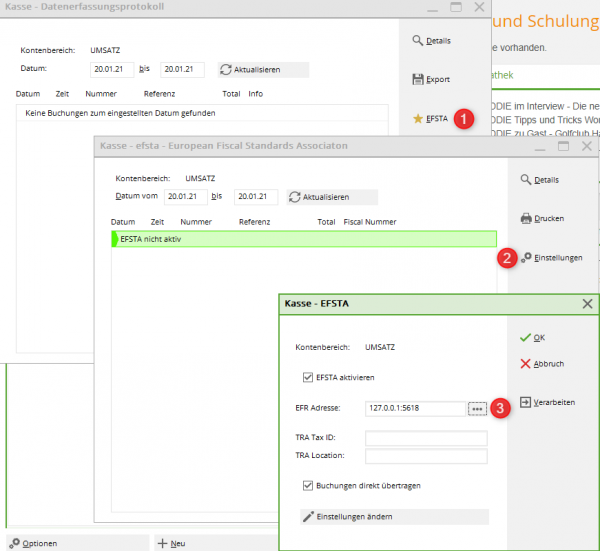

In PCC, go to SALES/CASH PROTOCOL and click as follows

1) EFSTA

2) SETTINGS

3) BUTTON WITH MAGNIFYING GLASS

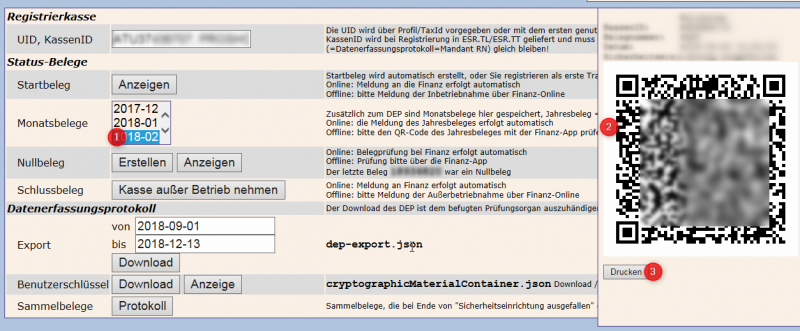

The EFR (interface to Efsta) now opens

Here, please select the „Control“ tab - there is a window with „Monthly vouchers“.

1) Click on one of the monthly vouchers 2) The corresponding QR code is displayed on the right.

3) You can print these vouchers via Print.

The last monthly voucher of the year is also the annual voucher. So if you create your monthly voucher with signature in December, you have also created the annual voucher at the same time.

Create annual voucher

To trigger the annual receipt, a posting must be made in your cash register in the new year.

If you only open your club in February or March and start with the cash register in the new year, we recommend that you deliberately create the annual receipt. If you already have bookings in the cash register in January, the following step is not necessary for you.

The easiest way to do this is to make a zero entry in the cash register for „walk-in customers“. A corresponding article was created during your installation: If you enter an „i“ under item in the cash register and confirm with „Enter“, this will be opened. Post the booking created in this way as usual. The ERA recognises this posting in the new year and generates the annual receipt and transfers it directly to Finanzonline.

Order certificates

The cash register guidelines of the Federal Ministry of Finance were introduced on 1 April 2017. For this purpose, the interface to Efsta „European Fiscal Standard Association“ was stored for all customers with the corresponding signature unit.

The signature units will now expire in March/April 2023. New signature units must be ordered for this purpose.

The new certificates can be ordered via the efsta portal as soon as the old ones expire. Each customer has been given access to the efsta portal and a password of their choice can be stored.

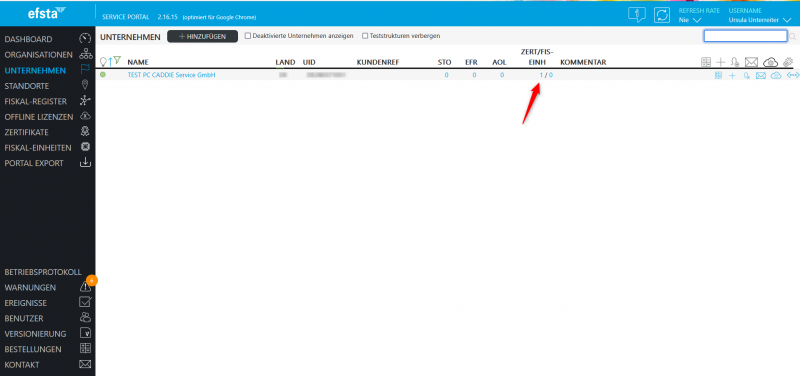

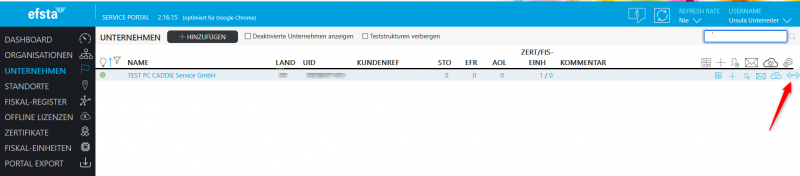

Please access the service portal and check the validity of your signature unit as follows:

If you are logged into the Efsta portal, you can find your company under Company: Then click on the 1/0 for ZERT/FIS unit

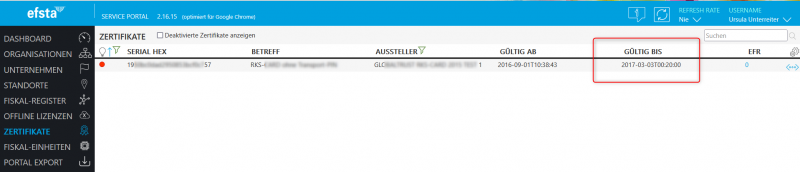

The following window now appears:

You can now see how long your signature certificate is valid for.

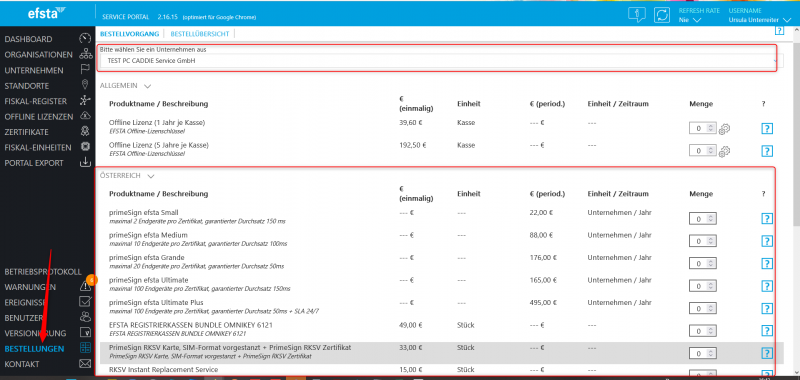

To extend it, go to Order in the Efsta portal: Select your company and place your order:

The certificate will be available in the efsta portal approx. 15 minutes after ordering (–> Fiscal units). The company should activate „automatic remote certificate assignment“ so that no manual intervention is necessary. The new certificate is assigned with the 1st transaction.

To activate the „automatic remote certificate assignment“, please click on the 3 dots on the far right of your company:

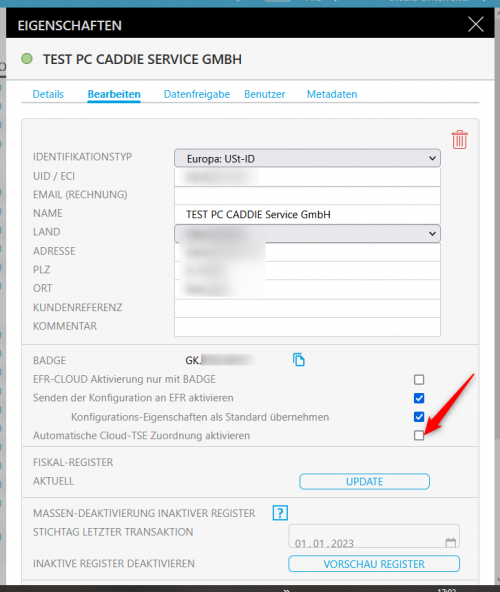

In the next window, click on the Edit tab and tick the „Automatic Cloud TSE assignment“ box

From the current perspective, the certificates that expire after 2023 will also be migrated in 2023, as PrimeSign has switched to new products. However, you will be informed about this separately.

The RKSV chip cards can still be used as normal. No replacement is necessary here.

- Keine Schlagworte vergeben